Case Study

Legal & General America Achieves NPS of 73 with AI-Driven CX

At-a-Glance

Legal & General America is committed to providing affordable life insurance and high-touch customer service. With the objective to enhance the customer experience through digital transformation, LGA enlisted SmartAction to automate common insurance inquiries and payment capabilities.

Success by the Numbers

Challenge

Legal & General America is one of the world’s largest insurance companies, paying close to $1 billion in claims to families and businesses every year. With a customer base of 1.3 million Americans and growing, LGA needed to expand its contact center resources to serve customers in all 50 states. However, upon reviewing the massive investment required to upgrade their contact center and the costs associated with hiring and training new agents, they began to explore other options.

In addition to the company’s expansion “problem,” LGA’s live agents were dealing with:

- A high volume of repetitive call types that were transactional in nature

- Less than optimal containment on payment call types, resulting in missed payments and lapsed policies

LGA needed a solution that would allow customers to self-serve routine interactions, remind them about upcoming or past due bills, and not require a technology overhaul in order to get there.

Solution

After considering several vendors, LGA chose SmartAction for their tailored approach to conversational AI, domain-specific knowledge with pre-built AI models for insurance, and conversation design expertise. Rather than a “cookie-cutter solution,” LGA wanted to create a seamless customer experience that would rival their best live agents.

LGA and SmartAction worked closely to deploy an intelligent virtual agent that assists customers with policy information, requests for forms, and common billing inquiries. Customers also have the option to make a one-time payment or sign up for auto-pay through the virtual agent. After initial deployment, LGA expanded their self-service capabilities to include payment reminders over voice and SMS, a feature highly requested by LGA customers.

Results

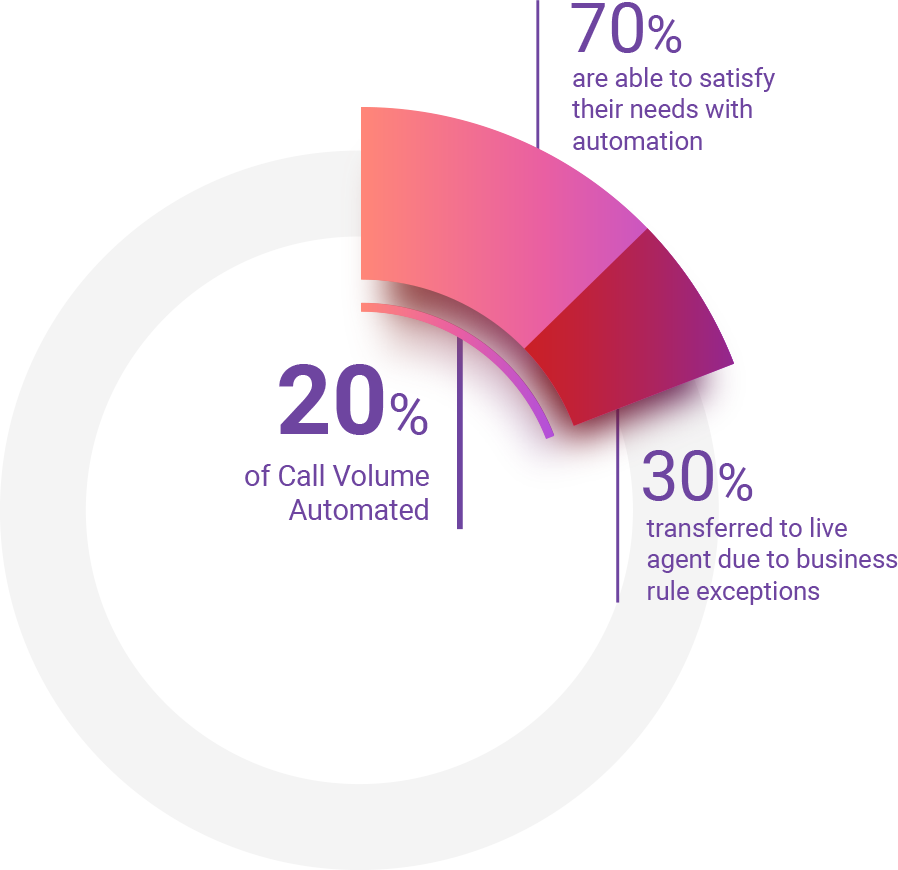

The repetitive, transactional call types that make up 20% of LGA’s call volume are now automated by the virtual agent, enabling live agents to focus on more complex and emotional issues that are inherent to life insurance discussions.

70% of customers who use LGA’s self-service options are able to satisfy their needs without waiting on hold or experiencing unnecessary friction. The remaining 30% of callers who get transferred to live agents are business rule exceptions that require transfer (due to not having their policy number handy or not having authorization).

With an impressive Net Promoter Score (NPS) of 73, LGA further delighted customers with intuitive, always-available self-service. Several thousand customers signed up to receive payment reminders — before LGA even had the opportunity to promote the new service. Payment reminders not only served to keep policies active; it also saved the company valuable time and resources, and validated the need for digital transformation in CX.

Roadmap

After seeing self-service success, LGA is working with SmartAction on a robust roadmap for future solutions, including an intelligent front door to greet every caller in natural language, capture intent, authenticate, and transfer to the appropriate live agent (or enable self-service if the captured intent is handled by an AI-powered virtual agent). LGA also plans to deliver an omnichannel experience by adding two-way texting and chat capabilities that maintain context when switching across channels.